1 Introduction

Point Topic tracks the changes in the standalone and bundled broadband tariffs provided by European operators every second quarter[1]. This report presents the latest tariff benchmarks at the end of December 2023. To put them into perspective, we are comparing the trends to June 2023.

The complete tariff data is available within Point Topic’s European Broadband Operators and Tariffs (EuroBOT) subscription service. We provide access to the raw data, as well as charts and tables for the tariffs offered. For the full methodology, see the Appendix.

2 What we measure

The tariff database covers all major fixed broadband operators across the EU, UK, Norway, Iceland and Switzerland. In total, we track more than 200 operators from 31 countries.

Standalone and bundled

We report tariffs where broadband is offered as the only service (standalone) and tariffs where broadband is offered with other services such as TV and telephony (bundled).

Residential and business

We report both business and residential broadband tariffs.

Technologies

Within this report we look at differences between the three major fixed broadband technologies – copper, cable and fibre. The full tariff database also includes some wireless and mobile broadband tariffs.

Changes to reporting

We have excluded all tariffs which report a monthly subscription charge higher than $5,000 PPP (purchasing power parity) or which report no monthly subscription charge.

We have excluded all VDSL tariffs from the DSL category and included them in the fibre category instead.

These changes do not affect the full tariff database but only this analysis. For more details on methodology see the Appendix.

3 Europe-wide tariffs and bandwidths

We have compared the average subscription charges and corresponding bandwidths for different broadband technologies across Europe. All prices are quoted in US dollars at PPP (purchasing power parity) rates to allow easier comparison.

3.1 Residential broadband packages

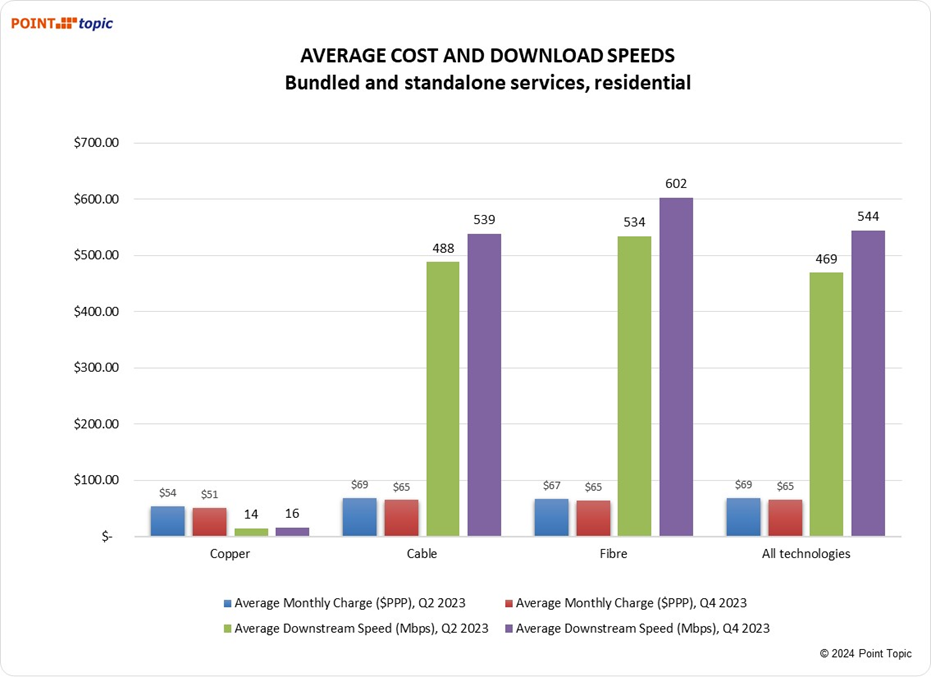

As of the end of December 2023, copper based residential broadband tariffs were the cheapest ($51 PPP) but they also offered the lowest average download speed at 16Mbps. Compared to Q2 2023, the average subscription over copper went down by 6.2%, while the speed went up by 16.2%, though compared to other technologies it was still low. The average monthly tariffs for cable and fibre broadband were very close ($64.67 PPP and $64.65 PPP respectively). However, fibre based tariffs offered a higher average download speed at 602Mbps, compared to 539Mbps over cable. Over the six months to end-2023, the average tariffs based on these technologies decreased by 5.8% and 4.1% respectively, while the average download speeds went up by 10.3% for cable and by 12.7% for fibre.

In Q4 2023, the average downstream bandwidth in Europe, regardless of technology, was 544Mbps, up from 469Mbps six months earlier (+15.9%). As FTTP and Docsis3.1 availability across Europe is becoming more widespread, we recorded 260 residential gigabit tariffs (with downstream bandwidth of at least 900 Mbps) in Q4 2023, though this number was slightly down from 269 such tariffs in Q2 2023.

In six months to the end of Q4 2023, the combined average cost per Mbps on broadband packages provided over the three technologies fell further, from $0.15 to $0.12 PPP. The drop was caused by decrease in the average cost per Mbps over fibre, cable and especially copper (Figure 2). In terms of the cost per Mbps, copper remains by far the most expensive technology at $3.13 PPP, but this metric went down by 19.3% since Q2 2023. We recorded only 77 copper based residential broadband tariffs this quarter, down from 81 in Q2 2023. In comparison, we tracked 137 cable broadband tariffs and 847 fibre broadband tariffs in Q4 2023.

3.2 Business broadband packages

We recorded the largest change in the average business tariff for copper – during six months to end-2023, the average monthly charge for this technology fell by 23.1%. In the same period, the average copper-based download speed went up by 25%. At 26Mbps, it was still very modest. Nevertheless, it appears that, like in the residential market, providers still offering copper-based broadband are trying to hold on to their customers by making the tariffs more attractive.

Businesses using fibre based broadband saw the largest boost in the average download speed – between Q2 2023 and Q4 2023 it went up by 43.4% as we saw more multi-gigabit tariffs on the market. At the same time, the average monthly subscription for these services has decreased by 15.3% as fibre broadband providers aimed to increase fibre take-up among business customers.

In the face of competition from fibre, cable broadband tariffs fell by 11.1% on average while the average bandwidth went up by 4.5%.

Between Q2 2023 and Q4 2023, the combined average download speed grew by 56.5% and stood at 920Mbps, largely thanks to the increase in the average speed over fibre (Figure 3).

Over the period of six months, the average combined cost per Mbps on business broadband packages went down by 37.6%, from $0.28 PPP to $0.18 PPP (Figure 4). This was mainly as a result of copper and fibre broadband services becoming less expensive as well as fibre based speeds shooting up. The average cost per Mbps on copper platforms has dropped by 38.5% while for fibre it has gone down by 40.9%. Cable connections also became cheaper by 14.9%. While broadband providers are trying to make their copper based services more attractive to customers on a budget, they are phasing them out, with just 57 out of the 891 business tariffs still based on this platform in Q4 2023.

4. Regional tariffs and bandwidths

In this section, we compare the average tariffs and bandwidths in Eastern and Western Europe. All prices are quoted in international US dollars at PPP rates to allow direct comparison between regions (Figure 5).

4.1 Residential broadband packages

At the regional level, we found similar average download speed and average monthly subscription in Eastern Europe and Western Europe. While average subscription was just above $64 PPP in both regions, the average download speed was slightly higher in Eastern Europe – 543Mbps compared to 535Mbps in Western Europe. In six months between June and December 2023, Eastern Europe saw a significant increase in the average speed (+32.6%) as the region’s operators introduced more ultrafast broadband tariffs. In Western Europe, the average bandwidth grew by a more modest 9.6%. In the same period, the average subscription fell more notably in the more saturated markets of Western Europe (-8.2%) compared to -1.8% in Eastern Europe (Figure 5). These changes brought the two regions closer together in terms of broadband offerings to residential customers.

At a country level, the countries at the top end of GDP per capita remain at the top of the league by average bandwidth (Table 1). However, Bulgaria, Croatia and Romania have also made the rankings this quarter as their operators introduced higher speed tariffs.

Table 1. Top ten countries by average speed, residential broadband, Q4 2023. Source: Point Topic.

Country | Average Downstream Speed, Mbps |

Switzerland | 3,238 |

Iceland | 2,471 |

Italy | 1,799 |

France | 1,044 |

Bulgaria | 802 |

Croatia | 755 |

Romania | 724 |

Finland | 704 |

Poland | 701 |

Portugal | 658 |

More or less the same countries top the rankings by the lowest cost per Mbps, although we can see some new faces too – Lithuania, Latvia and Czech Republic also made the top ten, reflecting the availability of high speed tariffs at relatively low prices.

Table 2. Top ten countries by the lowest cost per Mbps, residential broadband Q4 2023. Source: Point Topic.

Country | Average Cost per Mbps, $PPP |

Switzerland | $0.02 |

Italy | $0.03 |

Romania | $0.04 |

Iceland | $0.04 |

France | $0.06 |

Finland | $0.07 |

Bulgaria | $0.08 |

Lithuania | $0.08 |

Latvia | $0.10 |

Czech Republic | $0.10 |

4.2 Business broadband packages

In Q4 2023, Eastern European businesses were offered lower average monthly tariffs but they came with lower average bandwidth as well (Figure 6). Compared to Q2 2023, both regions saw an increase in the average speed (+47.6% in Eastern Europe, +51.9% in Western Europe), while the average subscription went down by 13.5% and 20% respectively.

5 Country ranking

In this section, we look at the average monthly tariff for residential broadband services. The average tariffs include copper, cable and fibre broadband services, and cover both standalone and bundled services.

All tariffs are quoted in international US dollars at PPP rates to allow comparisons between countries.

6.1 Entry level, median or average?

We are using the three most common comparison aggregations:

The entry level tariff – typically ignores variations in bandwidth caps, time charging, actual bandwidth offered and overall availability of a tariff in the market. Best used to indicate the conditions at the low end of the market and best comparator if you are looking at the market penetration for broadband overall or a particular technology.

The median tariff – the value in the middle of the count of all values in the set. It can be skewed by unbalanced reporting or data gathering. Useful as a general indication of the country market and for inter market comparisons.

The average tariff – doesn’t represent an amount anyone actually pays, skewed by extremes in price. The best single number for comparing whole country markets when you want to understand the range of options for the consumer.

There is a difference in the relative country performance depending on which metric is used and the variation can be significant.

The above chart (Figure 7) highlights some of the issues we have outlined above.

The relatively small spreads in Denmark, France, Czech Republic and Greece suggest that it is relatively easy to get more bandwidth, at least in terms of cost, however the entry level costs remain quite high in France, Denmark and Greece. Belgium is the most expensive market, with the average and median costs especially high. However, it has a large number of gigabit tariffs, especially those based on Docsis3.1.

Looking at the most expensive markets in terms of median tariffs (Figure 8), we also see some variation in the entry level and average ones. Upgrading to higher tier tariffs is especially expensive in Belgium, Norway, Portugal and Luxembourg, where operators offer different bundle options at premium prices.

Country ranking tables

Ranking countries using the average cost of broadband subscriptions is a straightforward idea but the variation in entry level versus median and average costs can be significant. To help provide an easy way of comparing directly we have taken the PPP data on the entry level, median and average tariffs, produced rankings and then compared the variance (Table 3).

We have included a ‘variance’ column to indicate how different ranks for the different metrics are spread. So we see that, for example, the wide spread in Italy, Malta, and Austria (big differences in entry level, average and median tariffs) is represented by high variance of the rankings. At the other end of the scale countries such as Romania, Ireland or Cyprus rank rather consistently.

However, it should be noted that this is only one set of metrics measuring one aspect of the broadband markets so conclusions should not be drawn in isolation.

APPENDIX: Notes on Methodology

The latest dataset of tariffs is available to the subscribers of European Broadband Operators and Tariffs service, and they can conduct their own analysis using this data. If you have any questions, please contact us on isabelle.anderson@point-topic.com.

The tariff dataset is updated every six months and it contains multiple fields, such as services included (to reflect bundling with broadband, e.g. video, VoIP, etc), monthly subscription, activation and installation charges, downstream and upstream speeds, equipment costs, length of contract, service features, and special offers.

The PPP rates used in this analysis are published annually by the World Bank and are readily available to the public free of charge. Some retrospective adjustments to PPP rates were made during the period 2000–2010. We updated all PPP rates during this period accordingly.

Price comparison issues

This analysis is intended as a general indicator of the trends in pricing in European broadband markets. There are several additional variables that complicate the process of making a direct comparison of broadband prices. These need to be taken into account when making a more in-depth analysis:

Some operators do not report speeds and / or prices for certain tariffs. This is especially common for business broadband. Entries which do not have both a downstream speed and a monthly rental listed have been excluded from this analysis.

ISPs are increasingly focusing on bundling value-added services in order to increase revenue. We started recording bundled services in Q1 2007. When analysing broadband pricing in this report, we include both standalone and bundled broadband services, which can skew the comparison. However, standalone broadband tariffs still constitute two thirds of all tariffs included in this analysis.

Some operators offer entry level services with data volume limits. In most cases, these limits are generous enough so as not to affect light or medium users. Point Topic includes this type of service as a reasonable entry level service, since it does not involve adding a usage charge to the monthly cost for the typical user.

The full data set used for this report can be access by purchasing our EuroBOT product.

[1] Until Q4 2022, we tracked tariffs in countries across all continents but from 2023 we decided to focus on Europe.

Comentários