Targets, build rates and where the deployments will be

The most recent upgrades to Point Topic’s UK postcode forecasts are now available.

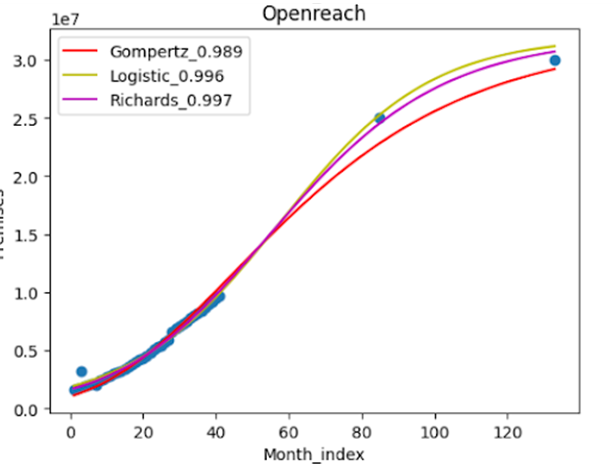

There are two segments. One set of forecasts reviews the current and historical build rates and runs models and scenarios against stated targets. For example, Openreach have announced 25 million premises passed by the start of 2027 given the right investment environment.

This serves as an endpoint and with the premises passed time series from our own data we can quickly arrive at a view of what their current rate of deployment is and how that has to evolve to hit their targets, see graph below.

Secondly we predict which postcodes the operators will deploy in to meet their targets. This is a more complicated and higher dimension problem. There are several variables that can influence operator deployment decisions and we attempt to establish what characteristics are attractive (or not) to an operator.

It is important to remember this is based on our own data which is not perfect itself. It takes us time to find the deployments of each operator and so we can lag operator premises passed announcements by up to 8 weeks.

That said we believe this is the most complete and up to date set available and as such we have a good level of confidence

Build rates

Tracking deployment rates with a good time series is vital for regression analysis. We now run three regressions across various cuts of our data to arrive at a well supported view.

Openreach for example have stuck to the plan very well to date and we expect them to achieve their stated targets all things being equal.

Openreach – current build, targets and fits (2020 to 2030)

We track 15 organisations and their build rates at the moment, where we have enough reliable data to produce projections. The full outputs including individual company progress are available to subscribers.

Postcode prediction

The second facet of the forecast upgrade relates to predicting which postcodes each operator will deploy to next and each half year out to 2030.

A more complicated issue with more variables. Regression analysis is still the fundamental principle but we use it across a selection of variables and constraints. See Operator deployments by postcode methodology below.

The outcomes are presented as postcode datasets, usually with the aggregate of the number of FTTP/DOCSIS3.1 operators in a postcode at a particular date. We also provide individual operator footprints for our subscribers. A brief overview is available from our previous analysis https://www.point-topic.com/post/uk-fixed-gigabit-broadband-availability-2022.

Methodologies – forecasts version 7

Build rates and overall targets

The primary objective is to arrive at a metric that allows us to examine the potential for an operator to meet their targets. All operators in the analysis have stated targets by a year for premises passed.

We use our own historical set as a training and validation sets.

The data we use for this version ranges from 2019-12-01 till 2023-07-01. We want to forecast 15 operators with varying levels of input data and time series.

We split this into 2 different sets:

First is from the beginning till 2023-04-01, the training dataset. Training set for each operator will contain one data point for target premises in 20XX from the operator announcements

Second is from 2023-05-01 to 2023-07-01, the validation dataset. We use this to evaluate the trained model and see whether the models (trained on training set) predict accurately or not.

For easy understanding, we use Mean Error Percentage (MEP) to estimate the difference from the prediction and the actual on validation set. This is simply measuring the difference of prediction to actual result in percentage. The formula for this:

With:

The result for running trained models against validation is then presented in a chart with the variances for each model. Again here is a sample:

Analysis and operator targets

The data used to limit the model is shown in table below:

Operator | Year | Target Premises | Source |

City Fibre | 2025 | 8,000,000 | |

Community Fibre | 2024 | 2,200,000 | |

GNetwork | 2026 | 1,300,000 | |

Gigaclear | 2023 | 500,000 | |

Gigaclear | 2027 | 1,000,000 | |

Fibrus | 2024 | 500,000 | |

Fibrus | 2026 | 1,000,000 | |

KCOM | 2025 | 350,000 | |

Be Fibre | 2027 | 1,000,000 | |

Zzoomm | 2025 | 1,000,000 | |

Openreach | 2026 | 25,000,000 | |

Openreach | 2030 | 30,000,000 | |

Table: Premises target of some operators and source of information

The challenge that remains can be reduced to how steep the curve is from now until the target date, or how fast will the operator have to deploy to meet their targets

Operator deployments by postcode

1. High level overview

The primary objective is to develop a predictive model that forecasts the deployment of FTTP (Fibre to the Premises) by broadband operators in the United Kingdom for each half year up to the year 2030. The forecast combines demographic and geographic data to evaluate the attractiveness of postcodes to operators, helping prioritise deployment in postcodes with higher attractiveness scores. Additionally, the project uses premises projections, indicating the number of premises passed by each operator in a specific timeframe.

2. Project scope

2.1 Operators

Currently, this forecast project focuses on 15 individual broadband operators:

Be Fibre

Brsk

CityFibre

Community Fibre

FW Networks

Fibrus

Gnetwork

Gigaclear

Hyperoptic

ITS

KCOM Lightstream

Openreach

Virgin

Voneus

Zzoomm

2.2 Postcode

For each operator, we will examine all 1.7 million postcodes, which is the total number of postcodes UK. In this forecast project, we use the Codepoint dataset with annual updates to allow the correct balance between regularity and consistency.

2.3 Broadband technology

This project specifically concentrates on forecasting the deployment of FTTP (Fibre to the Premises) technology by broadband operators.

2.4 Forecast period

The forecast project delivers results for every six-month interval from the time the forecast is initiated until the year 2030. These forecast periods are clearly presented in the "reported_at" field within the result table. To illustrate:

"yyyy-06-01" signifies the forecast results for the months of June through November in that respective year.

"yyyy-12-01" represents the forecast result for December of the current year and continues into the subsequent year, covering the months of January through May.

For example: if the value of the field “reported_at” is 2025-06-01, it signifies the forecast result for the period spanning from June to November in 2025. We’ll capture the result at the end of November 2025 (the end of the forecast period) as the deployment status for this forecast period.

Forecast methodology

This forecast model makes predictions based on 2 factors: the attractiveness and the premises.

The attractiveness metric estimates how attractive each postcode is to each operator, effectively establishing the order of deployment. High attractiveness postcodes take precedence in deployment planning, with operators prioritising them over less attractive postcodes.

The premises is the number of premises that we project broadband operators will deploy during the forecast period.

3.1 Attractiveness metric

This attractiveness metric is composed of 8 different factors, which are grouped into 2 categories:

General factor: these factors are not tied to any specific operator but reflect inherent characteristics of each postcode. There are 5 factors belong to this category:

Time since last upgrade (in days)

Population density

Cost of services in postcode (affordability)

Broadband infrastructure index

Digital deprivation index

Operator Specific factor: these factors are used to introduce individuality (of operator) into the attractiveness assessment for each postcode, making it distinct for each operator. There are 3 factors belong to this category:

Roadwork (new metric added in this version 7)

Network proximity

Overbuild sensitivity

These factor’s definitions and how they affect to the overall attractiveness are presented in the table below:

Roadwork metric: This metric is based on the data of digging road activities of broadband operators. If an operator is digging the road to set up premises at a specific area, then it’s likely for the postcode nearby to be covered by the FTTP service of that operator.

Estimate specific factors

A. Overbuild sensitivity

Each operator is assigned a score for how likely they are to deploy in a postcode that has other operators already based on past observations.

Each postcode is then given a score for how many operations are present in the postcode already. Then this score is normalised to 0 - 1 range before being multiplied by the overbuild sensitivity (which is 1 when they are most sensitive, 0 when they don’t care). The overbuild sensitivity of operators is presented in the table above.

B. Network proximity

When considering each postcode and operator pairing, a higher score is assigned if the operator has previously deployed premises in close proximity to the target postcode. The scoring ladder is presented in the table below:

This score is already in the scoring ladder therefore we don’t need to re-scale like we did with general factors. As this is a significant factor, the score range is higher than other factors. Finally, we add this proximity score into the overall attractiveness.

C. Roadwork

This metric measures how attractive a postcode is to a specific broadband operator, based on how close it is to where the operator is digging roads to set up their premises.

Specifically, if an operator starts digging the road in a specific area, we increase the probability of all postcodes within 200 meters of the digging position being covered by that operator's FTTP service. In other words, we increase the attractiveness of a postcode to an operator if it is within 200 meters of where that operator is digging the road to set up their infrastructure. The attractiveness metric increases by 5, which moves the postcode to the top of the priority list.

3.1.2 Estimate general factors

The general attractiveness factors are transformed to a scale ranging from 0 to 1. In this scale, 0 represents the minimum value after rescaling, while 1 represents the maximum value after rescaling.

Then for each postcode, we sum the re-scaled values of these factors to get its overall general attractiveness.

3.1.3 Estimate total attractiveness

Once we've calculated the attractiveness scores for all eight factors in each postcode for every operator, we'll add up these scores (except the overbuild sensitivity) to determine the overall attractiveness of each postcode for each operator. With overbuild sensitivity, we need to subtract to indicate the negative effect of this metric on attractiveness. We will then arrange these postcodes in descending order to create a prioritised list of deployment locations for each operator.

Premises metric

Beside using attractiveness metric to predict which postcode that operators are likely to deploy their operators, we also need to estimate how many premises we expect they will deploy.

The premises projection operates independently as a distinct forecast model, which we incorporate into this project as an input. In the premises forecasting model, we leverage our extensive historical data on past premises deployments to train our models. Additionally, we take into account announcements made by operators regarding their future rollout plans to inform our predictions.

Comments